Life is all about choices. This may feel especially true in today’s day and age when the number of feasible options that exist – really for anything and everything – seems to be increasing. It can certainly feel overwhelming at times. A wider and wider variety of small business loan products, programs, and lenders certainly don’t make the process of choosing an easy endeavor for small business owners in search of financing. Certain programs or products may be fairly well-known to the general public, like the Small Business Association (SBA) 7(a) Loan Program. However, there are also hidden gems out there with surprisingly unique advantages, such as the United States Department of Agriculture (USDA) Business & Industry (B&I) program. If you are an eligible business, the USDA B&I loan program may just be the product to unlock benefits that you didn’t know where possible to help your company grow.

The USDA B&I Loan Program offers loan guarantees to rural businesses. These loans are made by banks and guaranteed by the USDA. Some lenders, like West Town Bank & Trust, specialize in B&I loans and can help support a wide range of rural businesses with navigating the ins and outs.

What Type of Businesses Qualify for the USDA B&I Loan?

USDA business loans help rural small businesses obtain needed credit for just about any legal business purpose. What qualifies as a “rural small business”? Businesses that operate in an area of generally 50,000 inhabitants or less. For-profit and non-profit businesses, cooperatives, and Federally recognized tribes may qualify.

How Can the B&I Loan Funds Be Used?

Borrowers are eligible to use a B&I loan to start or expand a business. Potential ways to use proceeds include working capital, commercial real estate purchases, machinery or equipment purchases, business acquisitions, and debt refinancing (when used to improve cash flow and create jobs).

How Much Can Be Borrowed?

With a USDA B&I loan, businesses may borrow a total maximum amount of up to $25 million (under certain conditions when scoring guidelines are met and approved by the USDA National Office) with a maximum Loan-To-Value (LTV) based on available collateral:

- Max LTV for Commercial Real Estate is 80%

- Max LTV for Equipment & Machinery is 70%

- Max LTV for Inventory is 60%

What Are Terms for a USDA B&I Loan?

The maximum term on commercial real estate is up to 30 years. For machinery and equipment, it’s either 15 years or for its useful life, whichever is less. For working capital, it’s up to 7 years.

Interest rates can be fixed or variable (or in some cases a combination of both) and are set by the Lender. The percentage of the gross loan amount that the USDA will guaranty the Lender in the event the Borrower defaults is based on a range of the loan amount:

- Loans of 0-$5 million are 80% guaranteed

- Loans of $5-10 million are 70% guaranteed

- Loans greater than $10 million are 60% guaranteed

There is an initial guarantee fee the USDA requires borrowers to pay, currently 3% of the guaranteed amount, as well as an annual renewal fee, currently 0.50% of the outstanding principal balance. Reasonable and customary fees are negotiated between the Borrower and Lender.

Existing businesses must have a tangible balance sheet equity position of at least 10%. The position jumps to 20% for new businesses or start-ups.

Why Can USDA B&I Loans Be A Great Resource?

First, let’s briefly revisit the SBA 7(a) Loan Program. It’s very similar to the B&I Program based on how proceeds may be used and why the programs exist. Since SBA 7(a) is more commonly used, business owners are likely more familiar with the concept. While the two programs have overlapping features, it’s important for small business owners seeking a loan to understand the differences between the two programs and why B&I loans could be a stronger option to pursue.

Outlined below are several distinct differences and advantages offered through the USDA B&I Loan Program:

- Location – Let’s start with a big one. A Common misconception business owners tend to have about the Program is the perception of “rural” eligibility factors. Based on this eligibility map, you might be surprised. While businesses anywhere can secure SBA financing, local businesses benefit through B&I.

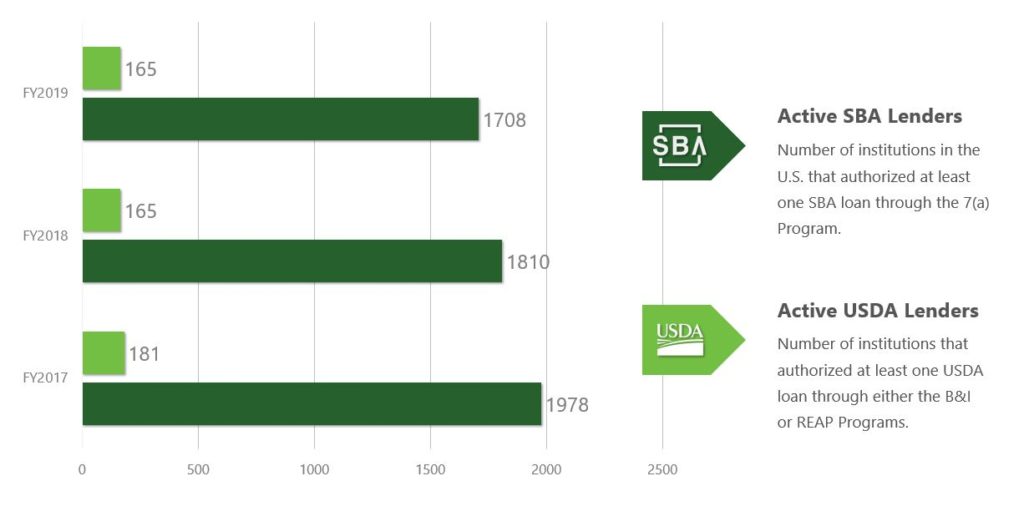

- Competition – There is far less competition among lenders for funding. In FY2019, there were 165 active B&I lenders that authorized at least one transaction versus 1,708 lenders that authorized at least one transaction through the SBA 7(a) Loan Program.

- Loan Amount – Loans max out all the way up to $25 million with approval from the USDA National Office (avg. loan size in FY2019 was $2.0 million). SBA 7(a) loans are capped at $5 million (avg. loan size in FY2019 was $446,000).

- Terms – B&I loan terms are longer for real estate transactions (up to 30 years) than SBA 7(a) terms (up to 25 years).

Longer maturities result in drastically lower monthly payments and conservation of cash flow, creating an opportunity to grow business operations faster.

Interest Rate – There is more flexibility surrounding interest rates. Lenders must set reasonable rates as determined by the USDA, and rates can be fixed, floating or even a combination of both (whichever makes the most sense for the Borrower).

Getting Started with a USDA B&I Loan

With a good understanding of how USDA business loans work and why they can be beneficial to rural small businesses, the next step is finding a specialty lender in the B&I space who you can trust. Out of approximately 5,000 FDIC-insured banks in the U.S., West Town Bank & Trust has ranked in the top 5 by total dollar volume authorize through the B&I and REAP USDA programs during each of the three previous fiscal years. West Town has successfully helped many rural businesses and is ready to help you.

Call West Town Bank & Trust now at 855-693-8290 to see if you qualify!

About West Town Bank & Trust

At West Town Bank & Trust, our most important goal is to understand what’s important to you, what’s getting in your way, and what you hope to achieve, so we can help you get there. Since 1922, we’ve been creating long-lasting relationships with our customers based on old-fashioned values and future-thinking ideas. Whether solutions come from surprisingly innovative tools or trusted products you’re familiar with, our single-focused purpose is your financial well-being.

During each of the previous three fiscal years, West Town Bank & Trust has ranked as a top 5 USDA B&I and REAP lender in the country by total dollar volume, authorizing nearly $400 million in financing collectively during this period.

About the Author: Riddick Skinner is Executive Vice President of West Town Bank’s Government Guaranteed Lending division. Providing strategic and business development oversight, Riddick is responsible for all SBA and USDA front-end loan production, including pricing, creative structuring, product diversity and strategic partnerships. Riddick’s primary niche has been within the USDA’s various lending programs. To learn more, email Riddick at [email protected] or call (919) 948-1986.