Among the many ways technology has significantly impacted the banking industry, none may loom as large as consumer expectations. People, and businesses, are getting used to – and sometimes demanding – improvements in speed and efficiency on a regular basis. But while small business owners look for quick lending solutions, they also wonder if it will be done right.

The most important thing that hasn’t changed in banking is a bankers’ ability to help small businesses conduct transactions safely and successfully. It’s why professional, experienced, trustworthy community banking partners are as important as ever.

For small businesses looking to take advantage of technology efficiencies and still make sure they have the assurance of a community bank by their side, there’s a solution:

Work with a bank that partners with technology service providers to enjoy the benefits of both worlds.

How We Got Here

For decades, small businesses have been the lifeblood of our nation’s economy. They create two-thirds of net new jobs* and account for 44% of U.S. economic activity.** Community banks have been at the heart of small businesses’ lending solutions, fueling their growth by providing the funds to help them thrive. According to the Independent Community Bankers Association, community banks fund roughly 60% of all small business loans across the country. Small businesses and community banks have successfully grown together for a long time.

Technology has also had a significant impact on small business lending solutions, especially over the last decade. According to the SBA’s FY 2019 Agency Financial Report, technology has evolved so that entrepreneurs have greater access to markets and more capabilities to start and expand their businesses.

There are several examples of how banks and borrowers can now connect more efficiently:

- Marketing Technologies – Customer Relationship Management system (Salesforce), Social Media (LinkedIn) and Automation (Pardot)

- Analytical Technologies – Credit Scoring (PayNet) and Spreading Financials (Sageworks)

- Operational Technologies – File Sharing (Citrix) and Electronic Signatures (DocuSign)

As FinTech (Financial Technology) has grown, we’ve seen the rapid emergence of FinTech lenders like OnDeck and Kabbage. Online marketplaces have appeared, acting as a catalyst for the small business lending community, creating new speeds and efficiencies on what sometimes seems like a daily basis. Online lending is growing and there’s no end in sight.

According to the Federal Reserve’s Small Business Credit Survey, an annual survey of small businesses, credit seekers are increasingly turning to online lenders. Over the past three years, the share of applicants that reported applying with an online lender increased from 19% in 2016 to 24% in 2017, and to 32% in 2018.

It’s easy to see the benefits FinTech lenders bring. Community banks that work best with small businesses don’t just recognize those benefits, they embrace them, because they enable banks to more effectively serve their small business clients. To get the best of both worlds, it’s important to be reminded of the difference between Fintech lenders and banks.

Marketplace lenders, such as OnDeck, Kabbage, and SoFi, can serve credit needs in markets where financial institutions would not traditionally lend, allowing small businesses to access otherwise unavailable capital. However, marketplace loans tend to carry higher interest rates than traditional bank loans. That’s one of many advantages of smaller community banks. Here are three more:

- Advantage #1: Assurance – Traditional banks are supervised by the OCC and/or FDIC, which provides an additional layer of consumer protection and safety by ensuring secure and reasonable rates.

- Advantage #2: Relationships – Community banks and bankers build long-term relationships through expanded financial resources, including deposits, mortgages, and credit cards. Successful small business banking is about connections, not just transactions.

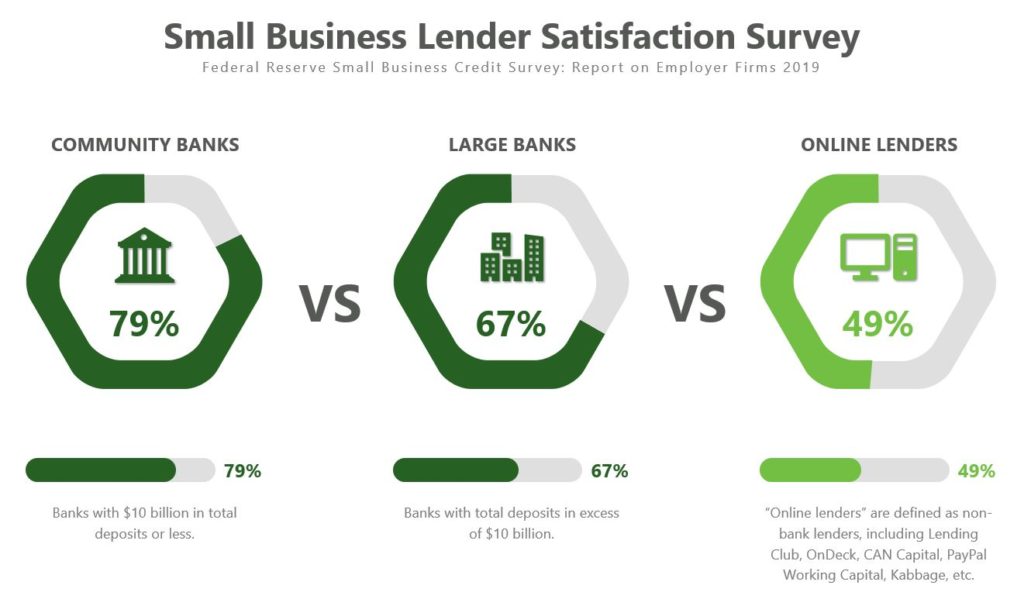

- Advantage #3: Expertise – It’s hard to overestimate the value of face-to-face expertise. At a community bank, you’ll work with a dedicated banker, so you can build a rapport with a trusted source of financing and have answers to your questions at your fingertips. According to the Independent Community Bankers Association, 79% of businesses that used community banks reported satisfaction with their overall experience, compared with 67% for large banks and just 49% for online lenders.

When it comes to SBA loans, what’s the best way for a bank to combine their assurance and expertise with the speed and efficiency that technology brings? Well, some banks may have the budget to spend $11 billion on technology upgrades like JPMorgan did last year (according to Forbes). But at West Town Bank & Trust, we don’t have to spend big to bring big value to our customers.

We‘ve partnered with Windsor Advantage, LLC (a Loan Service Provider to community banks) to create “Accel,” an efficient and effective funding platform for small business lending solutions across the country. Accel (a division of Windsor) became a leader in the SBA FinTech space by investing in a best-in-class technology-enabled program that delivers small business clients a seamless application, pre-qualification, underwriting and closing process for SBA 7(a) loans of $350,000 or less. Combined with our lending expertise, it’s a safe, secure, and efficient way to get your SBA loan through the 7(a) Program.

Getting Your SBA Loan

In closing, here is a snapshot of West Town Bank’s small business lending platform – what it is and where to start.

The SBA “Small Loan” platform at West Town Bank provides small businesses with a fully digitized application and prescreening process, resulting in highly efficient turn-times to funding. Here are the basic facts you should know:

- Loan Amount – Loans range from $10,000 to $350,000

- Terms – Up to 10 years fully amortizing with no prepayment penalty

- Use of Proceeds – Funds can be used for working capital, debt refinancing, equipment and business acquisitions

- Capital Requirements – 100% financing available for working capital and debt refinance only.

- Timelines – Secure funds in as quickly as 30 days from initial application

- Collateral – Best available lien position on business assets

It’s hard not to argue that technology has made banking better. But it’s also clear that even with all of the upsides around speed and efficiency, there are still opportunities to improve how technology affects your banking experience. This is especially true when it comes to finding small business lending solutions, where it’s as important as ever to have a banking partner you can trust for safety, expertise, and meeting and beating your banking expectations. With the right technology, coupled with the right banking partner, you’ll have the best of both worlds.

About West Town Bank & Trust

At West Town Bank & Trust, our most important goal is to understand what’s important to you, what’s getting in your way, and what you hope to achieve, so we can help you get there. Since 1922, we’ve been creating long-lasting relationships with our customers based on old-fashioned values and future-thinking ideas. Whether solutions come from surprisingly innovative tools or trusted products you’re familiar with, our single-focused purpose is your financial well-being.

West Town is one of the first banks to market to fully embrace partnerships with technology service providers to better serve its customers.

About the Author: Dalton Martier has nearly 10 years of financial services experience, ranging from retirement planning, mortgages, and SBA 7(a) lending. Dalton joined West Town Bank & Trust in 2021 as a Business Development Officer focusing on underserved SBA 7(a) small loans, ($100,000 to $350,000). Dalton earned his Bachelors in International Business, Management, and Marketing from the College of Charleston. Prior to West Town Bank & Trust, Dalton was a lead Account Executive for the Nation’s largest SBA lender service provider, Windsor Advantage, LLC. To learn more, email Dalton at [email protected] or call (843) 588-7186.

*U.S. Small Business Administration Office of Advocacy FY2019 Report

**U.S. Small Business Administration Office of Advocacy Small Business GDP, 1998-2014