- The SBA 7(a) Loan Program offers attractive terms for entrepreneurs in the process of growing their businesses.

- The 10-year repayment term for the SBA loan is a key factor that makes this loan a good option for working capital.

- Qualified business owners can leverage SBA loans to secure working capital with business-friendly rates. The capital can be used at the business owner’s discretion, giving them flexibility in how they choose to use the funds.

It’s been said that you must spend money to make money. But where should the money come from to fund your next phase of growth? Your own savings? Should you get another line of credit? Or maybe re-invest current profits?

The SBA loan is one of our most recommended loans for business owners that are serious about re-investing in their business. You’ll often see SBA loans referred to as ‘affordable capital’. In this article, we’ll walk through the reasonable, growth-friendly terms that make the SBA 7(a) loan a good working capital loan option for those that qualify.

“The SBA working capital loan is best utilized by strategic entrepreneurs that are ready to grow long term with ‘healthy’ debt. This financing solution is not meant to be a band-aid for poorly performing businesses. Rather, the SBA loan can be a springboard for growing companies ready to invest in their businesses on more favorable terms.”

– Director of Financial Advisory Lending, Robert Forslund

What Are SBA Working Capital Loans?

The Small Business Administration created a series of loan programs for small business owners, referred to as SBA loans. The most popular is the SBA 7(a) loan program, which authorizes government-guaranteed business loans of up to $5 million for qualified businesses.

SBA loans can be used for a variety of business expenses related to starting, growing, or building a business. Many entrepreneurs choose to use their SBA loan for working capital. By doing so, business owners can tap into the unique entrepreneur-friendly benefits of SBA loans while accessing affordable capital that can be used to accomplish their business goals.

Why are SBA Working Capital Loans Called ‘Affordable Capital’?

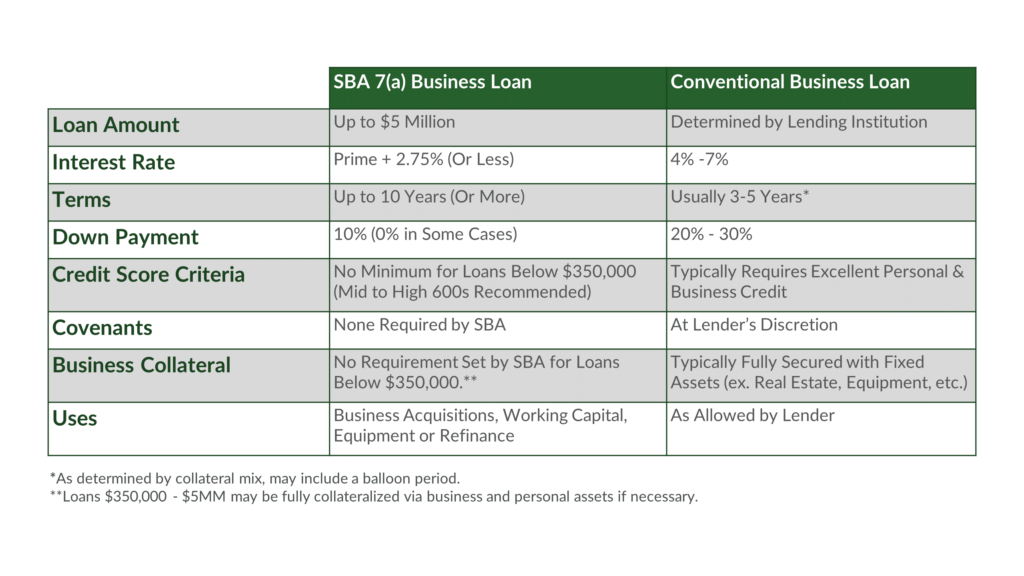

It’s likely that you would apply for an SBA 7(a) Loan as your SBA working capital loan. This loan’s terms include an extended 10-year repayment term. This longer amortization period is a major factor in classifying the loan as ‘affordable capital’ because of its impact on your monthly cash flow.

The SBA loan’s 10-year term is longer compared to conventional business financing options, which can reduce your monthly payment amounts by distributing those payments over a longer period.

Let’s look at a hypothetical example.

Say you were borrowing a gross loan amount of $300,000. You have the option of applying for an SBA working capital loan or a conventional business loan.

The SBA loan’s term is 10 years. While repayment terms vary from loan to loan, a conventional business loan term ranges from 3-5 years on average. We’ll assume this conventional business loan is a 5-year term.

Let’s set the conventional business loan’s interest rate at a conservative 7.0%. Interest rates for the SBA loan are variable and set according to the Wall Street Journal Prime Index (typically WSJ + a spread between 0 and 3%). We’ll assume the rate of the SBA loan is 9.0% for the purpose of this example.

Even with a higher interest rate, the SBA loan’s term lowers the monthly payment of the working capital loan by $2,140:

Notably, there are also no pre-payment penalties for SBA 7(a) loans with more than a 15-year term. Business owners have the option to make larger payments upfront (should they choose) without incurring fees. No penalties mean more liberty in how you choose to manage the debt long term.

What About SBA Loan Closing Costs?

Another benefit of the SBA working capital loan: it gives entrepreneurs the option to fold closing costs into the loan proceeds. By doing so, borrowers avoid fronting cash out of pocket for closing fees. The costs are bundled into the loan and financed along with the working capital over that 10-year term, helping the borrower retain their liquidity at closing. West Town Bank & Trust does not charge the borrower a packaging fee for closing an SBA loan. This packaging fee can often be $2,500 per loan.

How Do SBA Working Capital Loans Compare to Other Options?

There are multiple business loan alternatives to secure working capital for your business. However, these alternatives may come with significant opportunity costs. Though sometimes faster paths to capital, the terms of business loan alternatives are often more restrictive than even conventional loan options.

Two popular alternatives to business loans for working capital are:

- Merchant Cash Advance:

Merchant Cash Advance (MCA) is not a traditional business loan. It’s essentially an advance lump sum in exchange for future profits + fees. These have very short terms and often weekly payments, which can cause significant strain on business cash flow.

- Business Lines of Credit:

A business line of credit is often an unsecured line of credit that functions like a credit card to help small business owners. This option is typically used for seasonal cash flow needs or to supplement longer cash conversion cycles.

Compared to MCA debt or a business line of credit, the SBA working capital loan offers:

- Less frequent payments. MCA debt may require payments weekly, sometimes even daily. The SBA loan’s monthly payments distributed over a 10-year term are often less impactful on business cash flow than MCA or business line of credit payments.

- Potentially smaller payments. Thanks to the extended term and fully amortizing loan, the payments are usually smaller when compared to a similarly sized non-SBA loan, helping entrepreneurs maintain more sustainable cash flow.

- No pre-penalty fees. Unlike other debts, there are no penalties for paying off the loan early should your business benefit from resolving the debt before the 10-year term is complete.

The net impact of the loan is often healthier cash flow month to month even as borrowers pay back their working capital loan.

Who Can Leverage SBA Working Capital Loans?

Many different types of businesses qualify for SBA working capital loans. However, collateral-light service-based businesses are uniquely positioned to leverage the benefits of an SBA loan for working capital.

Service-based businesses like insurance agencies, financial practices, law firms, consultants, architectural firms, and even some medical practices may find it more expensive to access working capital with a conventional secured business loan. The SBA’s guarantee enables these service-based firms to close on a similarly sized working capital loan with better terms than some conventional financing options.

Should I Get an SBA Working Capital Loan?

There is not a one size fits all financing option. The right solution for your business is the one that puts resources in your hands at the right time to accomplish your goals without restricting your growth long term.

Is the SBA working capital loan the right solution? Use these general guidelines below to assess if SBA financing could be a better fit for your business over other alternatives to secure working capital:

You might consider using an SBA working capital loan if you…

- Already have an idea of how you would use the extra cash on hand to grow your business.

- Meet the SBA loan eligibility requirements and credit standards.

- Have time to invest in the application process to secure the long-term benefits of SBA-financed working capital.

- Understand the impact on your monthly cash flow.

You may not want to use an SBA working capital loan if you…

- Need immediate cash and cannot wait for a loan to process.

- Have low or non-existent credit, or your credit needs repair.

- Have not yet registered your business, or are a startup (in operation for less than 2 years).

- Could secure reasonable financing terms through another loan option.

Apply for an SBA Working Capital Loan

To get started with the SBA loan application process, check your eligibility using our online pre-qualification form. A lender will reach out to discuss your financing options and your next steps to funding:

About West Town Bank & Trust: A financing partner should reciprocate the level of trust you’ve built around your business. With a 100-year+ community banking history, West Town Bank & Trust works with entrepreneurs across the US to grow their businesses with proven financial solutions. West Town is a preferred SBA lender that has authorized over $550 million in SBA financing for entrepreneurs across the country.

Whether you’re interested in buying a business, facilitating growth without restricting cash flow, or getting a better interest rate on your existing loan, our team of financing experts is here to help you seize the opportunity.