On October 1, 2020, the USDA implemented a unified platform for all of its rural development guaranteed loan programs known as the One Rural Development (OneRD) Guarantee Loan Initiative. Under OneRD, the USDA removed regulatory barriers to make it easier for private lenders to use loan programs to invest in rural businesses and economic development efforts by eliminating duplicative processes and launching standardized requirements across the following four USDA loan programs:

- Business and Industry (B&I) Loan Program

- Rural Energy for America Program (REAP)

- Community Facilities (CF) Loan Program

- Water & Waste Disposal Loan Guarantees

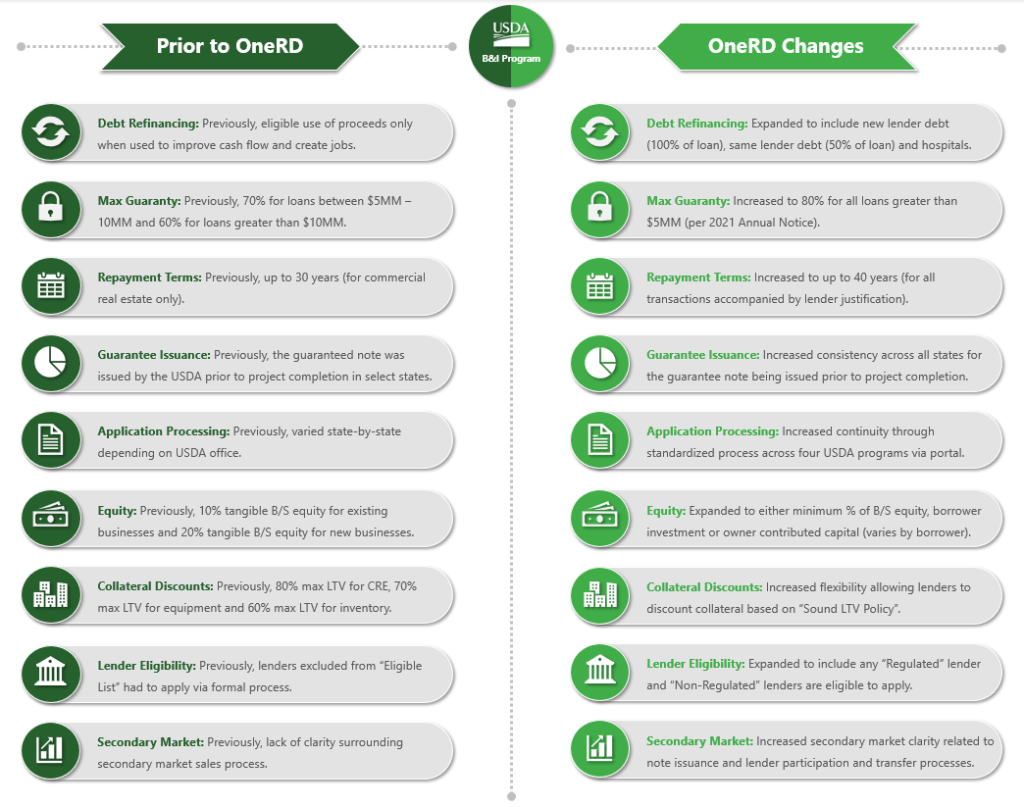

Major policy changes include automatic approval to lenders in good standing to participate, streamlined application processing, common applications, consistent population limits, lender-driven processes with commonly used lending practices, expansion of refinancing abilities and issuance of loan notes prior to projects being completed. Not only do consolidated rules and regulations provide increased continuity, but these updates also create new benefits for specific programs, including the USDA B&I Loan Program – the most widely used and diverse program of the four. This article highlights specific advantages for USDA B&I loan borrowers as a result of the OneRD initiative.

1. Expanded Base of Eligible Lenders

Previous regulations listed “Eligible Lenders”. If a lender was not specifically listed, they were required to undergo a formal review and approval process. OneRD now defines “Regulated Lending Entities” and “Non-Regulated Entities”. Through a single lender application, USDA provides automatic approval to “Regulated Lending Entities” in good standing that are supervised or created by State or Federal regulatory agencies to participate in all four programs. In addition, “Non-Regulated Entities” are eligible to seek approval to participate which remains valid for up to five years. This expands the base of eligible lenders and in-turn allows borrowers to choose from a larger group of financial institutions that to are eligible to participate in the B&I Program.

2. More Lenient Collateral Discount Requirements

Under previous constraints, maximum Loan-to-Value (LTV) requirements were established based on the type of collateral through the B&I Program (80% max LTV for CRE, 70% max LTV for equipment and 60% LTV for inventory). Under OneRD, collateral must have documented value sufficient to protect the interest of the lender and the Agency. Lenders are required to discount collateral consistent with sound LTV policies and discounted values must be at least equal to the loan amount. Although the lender must provide satisfactory justification of the discounts, borrowers now have the flexibility to work under the direct policies of the lender as opposed to guidelines set forth by the USDA.

3. Expanded Options for Equity Requirements

The OneRD rule removes the concept of “Tangible Balance Sheet Equity” requirements for borrowers through the B&I Program. This term had not existed anywhere else in the lexicon of financial regulations and was not recognized by the accounting profession in the context of GAAP accounting. This regulation was replaced with the requirement to have sufficient capital or equity to mitigate the on-going financial and operational risks of the business. There are now several ways for both new businesses and existing businesses to meet the B&I equity requirement, which must be met at the time of closing.

4. Additional Debt Refinancing Capabilities

OneRD states that if existing debt is owed to a lender who is not the lender applying for the loan guarantee, then the request for a loan guarantee can be for 100% of the loan(s) being refinanced. If the existing debt is owed to the lender applying for the loan guarantee, then the refinancing amount owed cannot exceed 50% of the total loan request. In addition, refinancing of rural hospital debt is a new provision to help preserve access to health services. Previous guidance simply stated that refinancing under the USDA B&I Program could be accomplished if the proceeds where being used to improve cash flow and create jobs in rural areas, which often times made it difficult for borrowers to pursue refinancing opportunities through the Program.

5. Increased Maximum Guaranty

To improve transparency and processing efficiencies, USDA now provides a standard guarantee percentage through an Annual Notice released for each program at the onset of the fiscal year. For the B&I Annual Notice for 2021, the USDA has set a standard guaranteed percentage of 80% for all loans. Previously, the guarantee percentage was tiered based on the loan amount (80% for loans under $5MM, 70% for loans ranging from $5MM – $10MM and 60% for loans in excess of $10MM). When considering transactions in excess of $10MM, a 20% increase in the guaranteed amount substantially mitigates risk for the lender and enhances the institution’s incentive for Program participation. These changes will ensure increased access to the Program among borrowers.

6. Consistent Early Loan Note Guarantee Issuance

Issuing the Loan Note Guarantee (LNG) prior to construction projects being finished was in fact already an option under the USDA B&I Program before OneRD. However, the concept of doing so was inconsistent state-by-state. With OneRD, all four programs will make this option available regardless of where the project is located, giving more borrowers peace of mind earlier in the process that financing will ultimately be secured. That said, there are risks to the Agency when issuing the LNG prior to project completion which means there are additional requirements, such as the borrower paying a 0.5% fee in addition to the one-time guarantee fee upon requesting an early LNG.

7. Extended Payment Terms

Each USDA program used to have separate loan amortization limits. In some cases, programs provided specific limits based on the type of collateral. For example, the maximum term for B&I loans would allow for repayment terms of up 30 years for commercial real estate transactions only. Through OneRD, lenders establish and justify the guaranteed loan term on a case-by-case basis which is subject to review of the Agency. The USDA’s parameters allow for a maximum 40-year proposed term limit. Longer maturities result in drastically lower monthly payments and conservation of cash flow, creating an opportunity for borrowers to grow their business faster assuming extended terms are justified and approved.

8. Streamlined Application Processing

The customer experience through the USDA B&I Program prior to the rollout of OneRD was inconsistent and choppy. Depending on which state office was handling the transaction, Agency point-of-contacts, systems and timelines varied. As part of centralizing standards across these four USDA programs, the application intake process is now streamlined and utilizes consistent application forms. Through one portal and one point-of-contact with the USDA, lenders and borrowers both have greater transparency into the status of every application. As a result, the Agency targets a 30-day window from filing to Conditional Commitment and 48 hours for issuing the guarantee when conditions are met.

9. Improved Secondary Market Sale Process

Under previous guidance, the secondary market sales process did not include sufficient documentation requirements of secondary market intent upon the loan guarantee being issued. In addition, loan participation and lender transfer processes were ambiguous. OneRD requires lenders to be clear with their intent to sell the loan and sets standards for the amount that must be retained by the originating lender (minimum of 7.5% of the total loan amount). Clarity surrounding these processes will encourage lenders to participate more frequently in the program without the burden of trying to manage a disjointed process, therefore resulting in increased access to the Program for borrowers.

As a result of the USDA consolidating eligibility requirements, credit review guidelines and loan processing channels across its four main lending programs, lenders and borrowers alike now have greater access to USDA financing options. Specifically, consistent standards and rules should allow more rural businesses to take advantage of the many benefits offered through the USDA B&I Program. Extended terms, faster turn-times and increased flexibility through the USDA’s OneRD updates reflect the Agency’s mission to provide a better overall experience for borrowers.

About West Town Bank & Trust

At West Town Bank & Trust, our most important goal is to understand what’s important to you, what’s getting in your way, and what you hope to achieve, so we can help you get there. Since 1922, we’ve been creating long-lasting relationships with our customers based on old-fashioned values and future-thinking ideas. Whether solutions come from surprisingly innovative tools or trusted products you’re familiar with, our single-focused purpose is your financial well-being.

During each of the previous three fiscal years, West Town Bank & Trust has ranked as a top 5 USDA B&I and REAP lender in the country by total dollar volume, authorizing nearly $400 million in financing collectively during this period.

About the Author: Riddick Skinner is Executive Vice President of West Town Bank’s Government Guaranteed Lending division. Providing strategic and business development oversight, Riddick is responsible for all SBA and USDA front-end loan production, including pricing, creative structuring, product diversity and strategic partnerships. Riddick’s primary niche has been within the USDA’s Business & Industry Program. To learn more, email Riddick at [email protected] or call (919) 948-1986.