You’ve found the right business, done the research, read the fine print, and now you’re ready to buy a franchise. Maybe you own a franchise and are exploring growth options. But how do you obtain the capital to take the next steps?

If you already own a franchise or are thinking of buying one, you could be eligible to fund your business with SBA loans. The government guaranteed loan program is known for its competitive terms and low interest rates, making it a viable option for securing access to capital.

In this guide to SBA franchise loans, we cover everything current and prospective franchise owners need to know about SBA loan options available to franchise brands.

Why SBA Franchise Loans?

Owning a franchise is an appealing option for a few reasons. A franchise operates with a model that has already proven to be successful and comes with a corporate reputation to back up the choice in your investment.

Even so, some lenders can be hesitant to grant loans to franchise owners, making it more difficult to finance the full amount needed to buy or run a franchise.

SBA loans were created to promote the growth of small businesses by providing an alternate option to conventional financing on reasonable terms. Using SBA loans to fund buying a franchise can help you secure the primary benefits of the incentivized loan program while providing the hard-to-come-by capital to buy or grow a franchise.

Benefits of SBA Franchise Loans in comparison to conventional financing include:

- Fully-amortizing, “patient capital” (no balloon payments)

- Extended maturities (preservation of cash flow)

- Potential for lower collateral requirements

- Minimal, or no, financial covenants

- No pre-payment penalties (< 15-year terms)

- Maximum interest rate thresholds set by the SBA

How Can Franchise Owners Use SBA Franchise Loans?

The SBA loan program has specific requirements for how the funds can be used, which are outlined in the loans’ eligible use of proceeds. In short, the SBA requires that loans are used to improve or establish a site to conduct your business, fund your operation’s soft costs, and/or refinance certain outstanding debts.

Given these requirements, business owners commonly use SBA Loans in the following ways to start or enhance their franchise’s operations:

- Starting or buying an existing franchise

- Paying franchise or royalty fees

- Opening new locations or marketing expenses

- Resolving cash flow issues

- Paying or training employees

- Making leasehold improvements

Which SBA Franchise Loan Program is Right for You?

There are multiple SBA programs business owners may utilize to start or grow a franchise. The type of loan you should apply for depends on the amount of capital your project needs and how you plan to spend the funds. The three most popular SBA loan programs for franchise owners are:

SBA 7(a) “Small Loan” Program

- Loans equipped with a streamlined application and approval process of up to $350,000 with a maximum repayment period of 10 years. Made by financial institutions and backed by the SBA.

- Eligible uses of proceeds include smaller expenses like inventory, supplies, and raw materials.

- SBA 7(a) Small Loans are best for, but not limited to, small business owners who likely already own a franchise and are seeking to finance their franchises’ “soft costs” up to $350,000.

SBA 7(a) Loan Program

- Loans of up to $5 million with a 10-25 year repayment period made by financial institutions and backed by the SBA.

- Eligible uses of proceeds typically include working capital, debt refinancing, equipment purchase and business acquisitions.

- SBA 7(a) loans are typically best for business owners who are in the initial stages of starting, buying, or running a franchise and have expenses ranging from $350,000 – $5 million.

SBA 504 Loan Program

- Long-term fixed asset loans up to $5.5 million with a 10–25-year repayment period. These loans are provided in conjunction with financial institutions and Certified Development Companies (CDCs) which are licensed by the SBA.

- Eligible projects include purchasing, constructing, or improving commercial real estate or long-term equipment. The 504 loan may also be used to refinance existing debt involving new facilities or equipment.

- SBA 504 Loans are typically best for franchise owners who are financing large purchases like real estate or equipment for a franchise they already own.

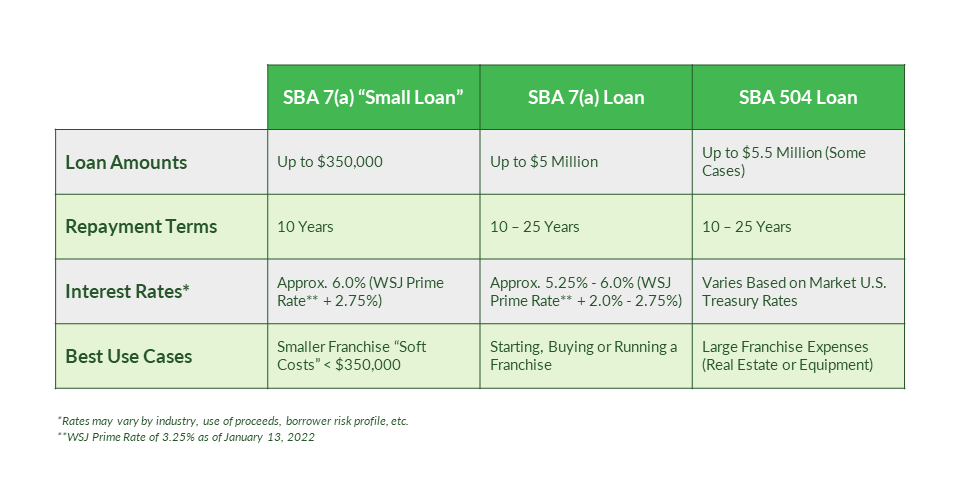

The SBA 7(a) Loan program is by far the most common due to the flexibility around how proceeds can be used. The following chart breaks down the key factors you need to know about each SBA franchise loan option available:

Is My Franchise Eligible for SBA Franchise Loans?

To receive an SBA 7(a) loan, a franchise must meet universal SBA 7(a) Loan Program requirements, franchise-specific requirements, and be evaluated by the lending institution as a viable and credit worthy financing candidate. According to the SBA, eligible businesses must:

- Operate for profit

- Be engaged in, or propose to do business in, the U.S. or its territories

- Have reasonable ownership equity to invest

- Use alternative financial resources, including personal assets, before seeking financial assistance

The lender will look at factors like your credit history, potential assets for collateral, business plan, franchise success rate, franchise model, and financial statements to determine whether or not you’re a candidate.

You’ll also need to meet the franchise requirements set by the SBA. SBA loans can only be used if the franchise is listed in the SBA Franchise Directory. This is a list of franchise brands that the SBA has determined meet the “independent business” standards. It currently includes more than 2,500 franchise brands.

If your franchise is not in the Franchise Directory, you can submit a request for its inclusion. Note, that it’s not guaranteed that the SBA will approve the franchise approval request, and the process will likely stall your loan application timeline by 6-8 weeks. Placement of a franchise brand in the Directory is not an endorsement or approval of the brand and does not ensure the success of the business.

How to Apply for SBA Franchise Loans

After you determine that an SBA franchise loan is a good fit for your plans, it’s time to begin the application process. Follow these steps to get started:

1. Determine Universal SBA Loan Eligibility

To determine your eligibility for a SBA Franchise loan, start by reviewing the SBA Loan Program standards. To be eligible, you must be a for-profit entity doing business in the US, have invested in equity for your business, and have exhausted your options to secure financing elsewhere.

2. Confirm that Your Franchise is Listed in the SBA Franchise Directory or Submit It for Approval

Next, check that your franchise is in the SBA’s Franchise Directory. If your franchise is not listed in the Directory, you can submit a request for it to be added by sending the following information to franchise@sba.gov :

- Complete copies of the franchise, license, dealer, jobber, or similar agreement(s) for the brand

- The Franchise Disclosure Document (if applicable)

- Any other documents an SBA applicant would be required to sign

- For non-franchisor/licensor inquirers, email contact information must be submitted for that individual

3. Begin the Formal SBA Loan Application Through an Approved Lender

Finally, complete your SBA franchise loan application. An approved lender can walk you through this process from start-to-finish while preparing your application for whichever program is most suitable based on your unique needs to mitigate the chance of the SBA denying it. Read our tips to keep in mind when beginning your SBA Loan Application for some context on what to expect throughout this process.

Ready to get started? Fill out the form below to check your eligibility for SBA franchise loans. One of our SBA-specialist lending officers will follow up with your next steps.

Check My SBA Franchise Loan Eligibility

"*" indicates required fields

About Capital Bank | Capital Bank has used the SBA 7(a) Loan Program to lend to franchises across the country for the last decade, providing loans to more than 100 franchises. Our most important goal is to understand what’s important to you, what’s getting in your way, and what you hope to achieve, so we can help you get there. Since 1922, we’ve been creating long-lasting relationships with our customers based on old-fashioned values and future-thinking ideas. Whether solutions come from surprisingly innovative tools or trusted products you’re familiar with, our single-focused purpose is your financial well-being.