The United States Department of Agriculture (USDA) partners with both public and private community-based organizations and financial institutions to provide funding to businesses located in rural areas, generally of 50,000 inhabitants or less. West Town Bank & Trust actively works with the USDA to provide financing through a variety of these programs, specifically the Business & Industry (B&I) and Rural Energy for America (REAP) programs.

As a result of increased lending activity in recent years, small businesses in rural areas are slowly becoming more familiar with the B&I Loan Program. This program offers borrowers who operate in rural areas competitive financing packages to help support business growth that will ultimately have a positive economic impact on the local community. Some of the key benefits (unavailable through most guaranteed loan programs such as the SBA’s 7(a) Program) include the flexibility for borrowers to secure larger loan amounts, longer terms, and alternative fixed-rate options.

While you may be familiar with the B&I Program and its benefits, there are a number of reasons you might want to explore the USDA REAP Loan Program. But first, let’s discuss its specific function and break down some of the similarities and differences to the B&I Program.

What Is A USDA Reap Loan?

USDA REAP loans are critical to increasing our country’s energy independence. It’s an area that’s both ripe with opportunity and important for our nation’s future. Funds can be used to develop power generation systems, including biomass, geothermal, hydrogen, and most commonly wind and solar generation. REAP loans can also provide funds for energy-efficient facility improvements such as lighting, HVAC, and doors or windows.

Loans approved through the REAP Program target agriculture and rural small businesses that are interested in purchasing or installing renewable energy systems or making energy efficiency improvements.

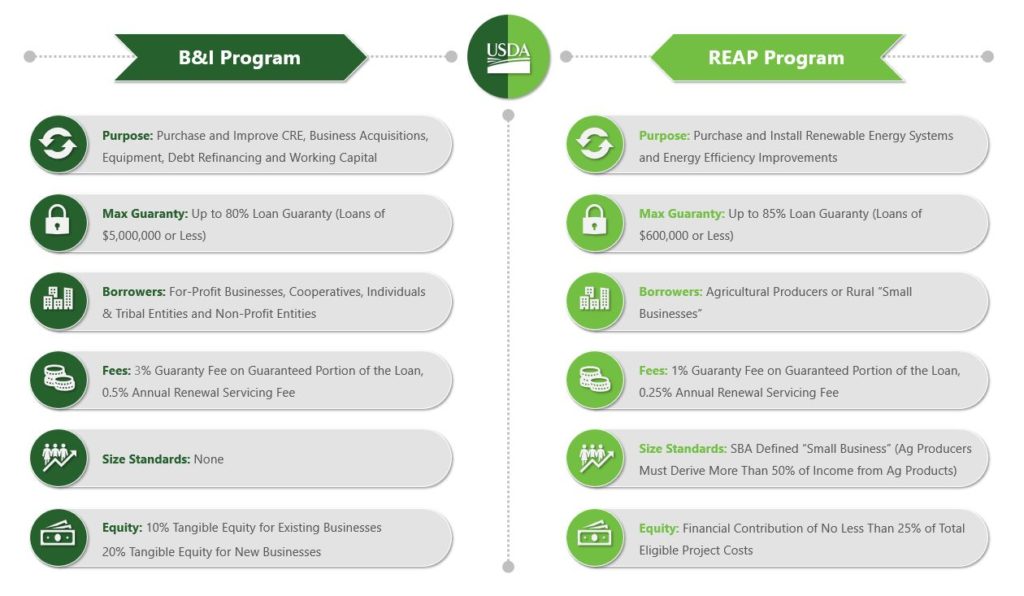

While loans through both programs must be for borrowers located in an area of 50,000 inhabitants or less and have similar maximum loan amounts (up to $25 million under certain conditions), maximum terms (up to 30 years for real estate), as well as interest rate flexibility (fixed, floating or both), there remain several key differences that should be considered.

You can see that there’s a great purpose for the USDA REAP loan. There are also great possibilities. Let’s look at five reasons you may want to consider a REAP loan for your business that aren’t blatantly obvious.

5 Reasons You Should Consider A USDA REAP Loan

#1 – REAP Loans Can Be Used for a Diverse Range of Renewable Energy Projects

“Utility-scale solar” is one of the most frequently discussed phrases in renewable energy. A utility-scale solar facility is one that generates solar power and feeds it into the grid, supplying a utility with energy. It’s a great combination of purpose and possibility and it’s no wonder that the REAP Program can finance projects related to this activity. However, this is just the start. Proceeds can also support a wide variety of needs, including biodiesel and anaerobic digester facilities, as well as projects related to the generation of energy through wind, hydrogen, and the ocean.

#2 – REAP Loans Can Be Used for A Wide Variety of Energy Efficiency Improvements

According to the Center for Climate and Energy Solutions, renewable energy is the fastest-growing source of energy in the U.S., increasing 100% from 2000 to 2018. Rapid growth in the industry requires increased amounts of capital to support purchasing, installing, or constructing brand new renewable energy systems. REAP financing not only applies to these types of new projects, but also to energy-efficient improvements, ranging from replacing energy-inefficient equipment (such as ventilation and air conditioning) to installing new lighting, solar panels, doors, or windows for a business facility.

#3 – REAP Loans Go Beyond Agricultural Businesses

Many people hear “USDA” and immediately think “Agriculture.” After all, the four-letter acronym includes the word “Agriculture.” But don’t be fooled by the name. As long as you’re a business that operates in a rural area and meets the SBA’s definition of “small” (less than $5 million in after-tax annual income and less than $15 million in tangible net worth), you’re eligible to obtain financing through the REAP program, regardless of the type of business you operate.

#4 – REAP Loans Have Extremely Attractive Rates, Terms & Conditions

USDA loans tend to offer more flexible terms, longer amortization and provide the option of a locked rate. These advantages are limited through the SBA 7(a) Loan Program. Compared to the B&I Program, the USDA REAP loan carries a higher maximum guaranty percentage, as well as lower guaranty and annual renewal fees.

#5 – REAP Loans Don’t Need to be a Cumbersome Process

The key here is working with a bank that has time-tested and streamlined ways of doing business. When working with a lender well-versed in the USDA’s application and approval process, with a track record of success partnering with numerous USDA state offices across the country, you increase your chances of steering clear of easily avoidable headaches. Make sure your banking partner is an industry-leading expert when it comes to understanding the nuances of this niche program.

A USDA REAP Loan can be a great resource for rural small businesses interested in installing or improving renewable energy systems. If you think a REAP loan may be a good option for your business based on its purpose and range of possibilities, make sure that you select a banking partner with a proven history of success.

Learn More About USDA REAP Loans for Renewable Energy Financing

About West Town Bank & Trust

At West Town Bank & Trust, our most important goal is to understand what’s important to you, what’s getting in your way, and what you hope to achieve, so we can help you get there. Since 1922, we’ve been creating long-lasting relationships with our customers based on old-fashioned values and future-thinking ideas. Whether solutions come from surprisingly innovative tools or trusted products you’re familiar with, our single-focused purpose is your financial well-being.

During each of the previous three fiscal years, West Town Bank & Trust has ranked as a top 5 USDA B&I and REAP lender in the country by total dollar volume, authorizing nearly $400 million in financing collectively during this three-year period.

About the Author: Riddick Skinner is Executive Vice President of West Town Bank’s Government Guaranteed Lending division. Providing strategic and business development oversight, Riddick is responsible for all SBA and USDA front-end loan production, including pricing, creative structuring, product diversity and strategic partnerships. Riddick’s primary niche has been within the solar electric power generation space through USDA’s Rural Energy for America Program. To learn more, email Riddick at [email protected] or call (919) 948-1986.